Content

Some inventory might have one stage of machining done and other inventory might have all but one stage of machining done. Any materials during the manufacturing process work in process inventory account are considered work in process inventory. You can uncover ways to optimize your supply chain to generate greater profits by understanding work-in-process inventory.

- Finished goods refer to the final stage of inventory, in which the product has reached a level of completion where the subsequent stage is the sale to a customer.

- The balance represents manufacturing costs of unfinished production at the beginning of the period.

- Table 1.4 “Accounts Used to Record Product Costs” summarizes the accounts used to track product costs.

- Since WIP inventory takes up space and can’t be sold for a profit, it’s generally a best practice for product-based businesses to minimize the amount of WIP inventory they have on hand.

So, if you do quarterly reporting, you’ll need to know the ending WIP inventory for the previous quarter, which is carried over as the beginning WIP inventory for the coming quarter. Yes, monitoring your WIP inventory can be tedious, but it’s essential for effective inventory management and to check how well your supply chain is performing. Any business should always be aware of exactly what it has in stock at every stage of inventory, including WIP. The value of WIP inventory is often not the final amount, as costs for storage and transportation are added later. Since it takes up storage space and isn’t yet ready to be sold for a profit, businesses usually try to minimize the amount of WIP inventory they have on hand. The type of accounting system used affects the value of the account on the balance sheet.

Work-in-process inventory definition

They reserve work in progress for larger-scale projects like consulting or construction work. The above work in process inventory definition explains the what, but not the why. At the beginning of the accounting period in March, Superior Glass had $7,000 in the WIP inventory account. As such, the difference between WIP and finished goods is based on an inventory’s stage of completion relative to its total inventory.

You’ll have to have a basic understanding of the inventory cycle and double-entry accounting methods to make the proper entries. WIP inventory counts as a current asset, so it’s essential to include it on your balance sheet. If not, your total inventory will be undervalued and the cost of your finished goods will be overstated.

What is Work in Process Inventory and How-to Calculate it (WIP) + Formula

Only some, but not all, necessary labor has been performed with it. WIP, along with other inventory accounts, can be determined by various accounting methods across different companies. Accounts payable turnover requires the value for purchases as the numerator. This is indirectly linked to the inventory account, as purchases of raw materials and work-in-progress may be made on credit — thus, the accounts payable account is impacted. The valuing of WIP inventory tends to be a bit complex as one must understand precisely where the stock stands.

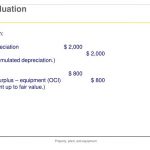

The formula to calculate both terms, however, is mostly the same for accounting purposes. The time required to make a good or product, in this case, a building, is much longer and requires more material and manpower as compared to a factory or consulting project. Besides these costs, ABC also incurs manufacturing overheads in the form of worker benefits, insurance costs, and equipment depreciation costs. Once the product has moved past WIP, it is classified as a finished goods inventory.

What is the accounting entry for work-in-progress?

A work-in-progress journal entry is a record that accounting professionals use to document current assets on a company's balance sheet. The items in this journal entry don't include any raw materials or finished goods.